Q&A with NH Fiscal Policy Institute Research Director Phil Sletten

‘If you look at the data from 2019 to 2023 … about 77% of the people who moved to New Hampshire from another state or another country were under the age of 45.’

Since 2016, Phil Sletten has served as research director for the New Hampshire Fiscal Policy Institute, a nonpartisan independent policy research organization founded in 2009 that examines the state budget and state revenue, focusing on the impact on people with low and moderate income.

The Institute studies both state and federal policy as well as local policy and its effect on the economic well-being of Granite Staters.

Sletten is a regular contributor to NH Business Review through the Institute’s policy updates and other research materials.

Q. We recently published your article that outlined five myths about New Hampshire’s economy, poking at things that many people think, such as that Massachusetts is driving the economy or just old people are driving the economy.

A. Part of what we hear when we’re giving presentations, when we’re seeing comments on social media, are beliefs that people have that may have been true at one point but maybe are a little less true now if you follow those data trends.

Something I hear very often is that most of the people moving here are people moving here to retire. Actually, if you look at the data from 2019 to 2023, the most recent data we have, about 77% of the people who moved to New Hampshire from another state or another country were under the age of 45.

New Hampshire has benefited in the past from being attractive to people in their late 20s, 30s and early 40s who have children or who are about to have children. That is a classic route for New Hampshire to grow its population. And we’re continuing to see that. That doesn’t mean those are the only folks moving here.

It doesn’t mean that, on net, we’re keeping everyone in those age groups. For example, in people in their 20s, especially the early 20s, they’re a little bit more likely to move away from New Hampshire.

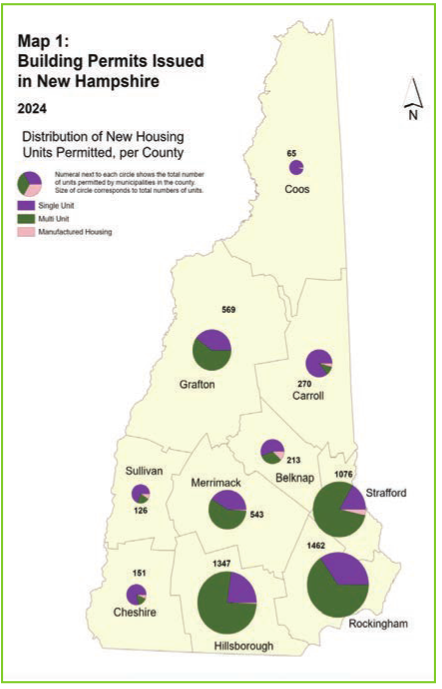

Q. Does that tend (to attract young people) to the southern part of the state, as we see in Manchester, with all the apartments popping up?

A. People have to be able to afford to live here and being able to afford to live here if you’re not selling a house somewhere else and moving into New Hampshire and buying a house with those assets that you have. For younger people, it may mean accessing more affordable places to live. That tends to be rental units. We see renter median household income in the state is about half of what it is for homeowners.

Q. Another myth is how everybody thinks Massachusetts is buying up all of our inventory.

A. If you look at the years 2018 through 2022 and the average over that time period of deed transfers, meaning who’s purchasing property in New Hampshire, more than 70% of deed transfers during that time were by someone already in New Hampshire buying property in New Hampshire.

If we look at the data from Massachusetts or in terms of people from Massachusetts buying property in New Hampshire in all those years, then it’s between 15% and almost 20%.

Q. Some of the affordability factors that people face here are similar to other parts of the country. Talk about some of the ones that are unique to New Hampshire, or at least more pronounced here.

A. Housing is definitely one of those key affordability factors. In our report that we published back in October, we looked over a 20-year time span to see some of the key drivers of affordability, or lack thereof, in New Hampshire.

The swings in housing prices were the biggest factor in terms of whether a family of four with a median household income could afford to live here.

The other two primary cost drivers that we were able to track over that 20-year period were out-of-pocket health care expenses. That was actually the fastest percentage increase after housing, and then the fastest dollar increase was child care. Over that 20-year period, early care and education costs that households faced rose very significantly.

One of the important things to think about nationally, but this is true in New Hampshire as well, particularly with housing, is that there’s a structural affordability challenge. A lot of the goods that we used to think of as the expensive goods — a large TV or something like that — have become less expensive as a percentage of household income.

Whereas the things that we all need in some form or another — housing, health care — have become more expensive and been a larger and larger share of household budgets.