The Pulse: Strong growth, fewer jobs

Is the New Hampshire economy up or down?

No doubt that the New Hampshire economy has grown strongly over the last five years.

In the 5 1⁄2 years from Jan. 1, 2020, to last June, the gross state product — the broadest measure of economic activity — has grown 12.5%, which includes the dip and rebound of the COVID-19 pandemic.

Unemployment has been low. Paychecks have steadily risen, as have property values.

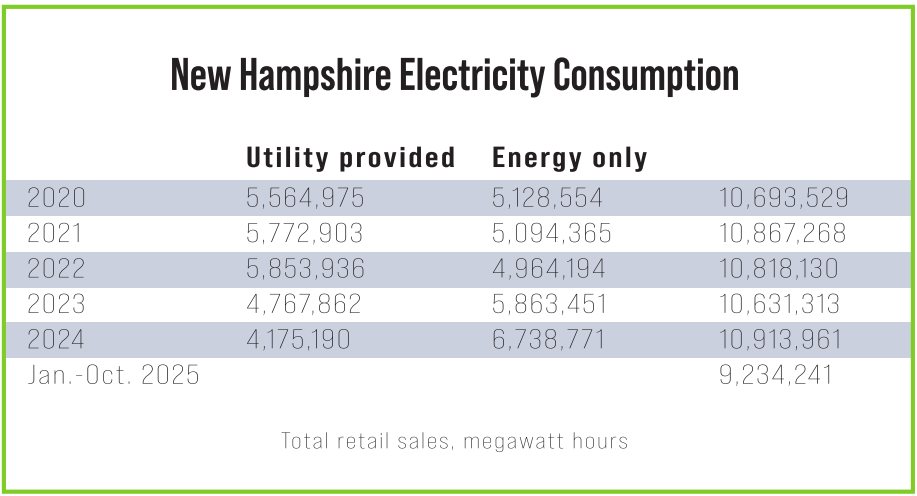

Yet, one key measure of economic activity is surprisingly lackluster. For the five years from 2020 to 2024, the overall consumption of electricity has been basically flat.

The total megawatt-hours of electricity sold in the Granite State has grown by only 2% over those five years, according to data compiled by the U.S. Energy Information Administration.

The agency released the 2024 totals in November. The first 10 months of 2025 show little deviation from the trend. A preliminary count shows that total electricity sales for

January through October came in at 9.23 million megawatt-hours, and the EIA estimates that the consumption for 2025 will be similar to 2024.

A decoupling of economic growth from electricity use would be unheard of in the 20th century.

But has that moment arrived?

“We don’t expect that trend to continue long-term,” said William Hinkle, spokesman for Eversource, the largest electrical utility in the state.

Hinkle gives two reasons for stable usage during the recent past, the primary being energy efficiency.

Measures such as LED light bulbs are so common that incentives have been phased out.

Residential customers have weatherized their homes, and commercial and industrial customers use energy-efficient equipment whenever possible.

The other reason for low consumption is the nature of the economic expansion of the last five years, Hinkle said. Much of the expansion occurred in the service sectors, which use less electricity than industrial users.

But Eversource predicts higher demand for electricity in the future.

The company predicts a net growth of 80 megawatts over a 10-year period that began in 2023.

“As we continue to see more manufacturing coming to the United States, it will be harder to keep energy prices stable,” Hinkle said.

Meanwhile, New England has not consumed as much electricity as planners had forecast, said Chris Ellms Jr., deputy commissioner of energy for New Hampshire.

He noted that consumer transitions to electrical vehicles, heat pumps and other electricity-powered equipment has not been as aggressive as expected.

The shift away from electricity has created some changes to usage and generation that are noteworthy. According to the Energy Information Administration:

• New Hampshire is among the 10 states that uses the smallest amount of energy, which includes electricity, for every dollar of gross state product created.

• Only three states have lower carbon-dioxide emissions than New Hampshire.

• The state ranks seventh lowest in per-capita retail sales of electricity.

• Power plants within the state generate more electricity than is consumed in New Hampshire, with excess generation sent to other states.

And yet, the state has some of the highest rates for electricity in the country.

For 2024, the Energy Information Administration ranked New Hampshire’s average residential, retail price of electricity at $27.82 a kilowatt-hour. New Hampshire’s retail price comes in as seventh highest in the country, just below Maine and ahead of New York.

The New Hampshire Consumer Advocate, which advocates for consumers in rate setting cases, cites several factors for the high rates on its website: the state’s distance from sources of fossil fuel, cold winters, high transmission costs and grassroots opposition to new power plants.

The data also show a shift away from utility-provided energy.

Starting in 2023, energy-only providers sold more electricity to New Hampshire customers than utilities did. In 2024, the last full year that data is available, non-utility companies sold nearly 62% of all electricity in the state.

Under state law, Eversource owns no power-generation facilities, and its energy charges cannot exceed what it pays for power, Hinkle said.

Its main business involves the transmission of electricity to customers.

“We want our customers to pay the lowest possible price,” he said.

Hinkle said 45% of Eversource customers buy their energy from another provider. Nearly all large-scale users and medium-sized users purchase power from sellers other than Eversource.

About 43% of residential users go outside Eversource to purchase their electricity.

Hinkle gave two reasons for the customer migration. One was price shocks in 2022 that he attributed to the Russian invasion of Ukraine. That impacted the price of natural gas, the second largest power source in New Hampshire for electricity generation.

The other is the formation of community power aggregations, where towns group residents together in order to purchase power at favorable rates.

A decoupling of economic growth from electricity use would be unheard of in the 20th century. But has that moment arrived?

“The Pulse” is an exclusive feature of NH Business Review that examines local and national data to track New Hampshire’s economy.

Each month, the series examines an economic trend based on the latest data. On a quarterly basis, “The Pulse” will report key economic indicators such as employment, inflation and economic growth for the New Hampshire economy for a more expansive review that includes several informational graphics.

“The Pulse” focuses on three key indicators: prices, output and labor. It will also feature a wild card category. One of the six will change every quarter in an effort to capture data that gives additional insight.