The Pulse: Strong growth, fewer jobs

Is the New Hampshire economy up or down?

Economists and financial journalists across the United States have been scrounging for updated economic indicators ever since Oct. 1, when the federal government shut down.

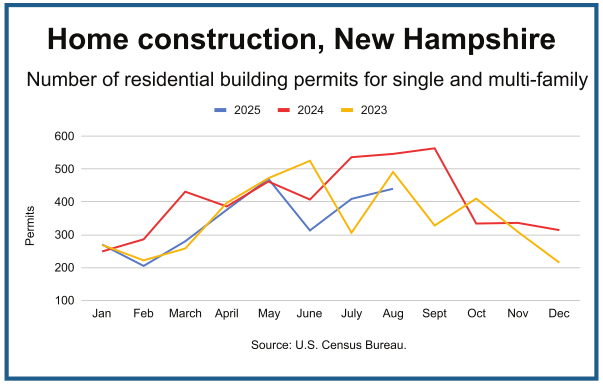

The shutdown halted the reporting of key economic statistics such as unemployment rates, paycheck amounts and housing starts. The Pulse relies on such data, although not exclusively.

In some measurements, our report this month is limited to data from the first two months of the third quarter: July and August. That data had been compiled and released before the shutdown.

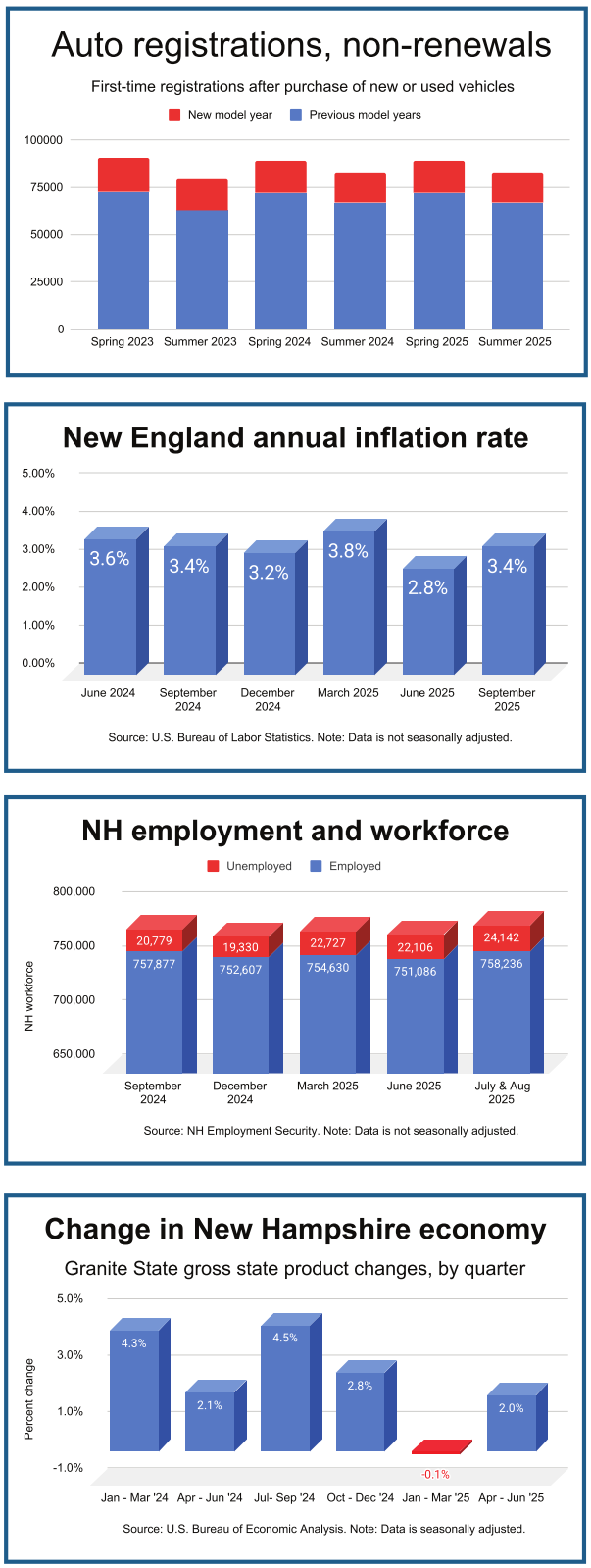

But the Pulse has updated data when it comes to motor vehicle registrations, which are handled by state government and not subject to the shutdown.

And our inflation data is current. Three weeks into the shutdown, the U.S. Bureau of Labor released data about inflation. Officials had deemed the numbers essential in order to adjust Social Security checks.

The data shows that New England experienced a significantly higher annualized inflation rate — 3.4% average for the third quarter — than the country. The country’s rate of 3% was higher than expected.

Automobile registrations, obtained through New Hampshire Division of Motor Vehicles, show that sales volume during the second and third quarters have been consistent for three years.

Auto sales are heaviest in the second and third quarters.

Sales for these past three years have been slightly lower compared to pre-COVID pandemic sales, thanks to inventory challenges, said Jeremy Seeley, director of sales and administration at Grappone Automotive Group.

“After COVID, there were extreme inventory shortages. The last three years have seen similar volume due to available inventory stabilizing slightly, while demand is still keeping pace with supply,” Seeley wrote in an email.

Grappone experienced a surge in sales this past March and April because of scares over the effect that tariffs would have on auto prices, he said. Going forward, the industry has concerns about inflation and affordability of autos because of tariffs, he said.

Other than inflation, the federal government has not released September statistics on paychecks, housing starts and employment numbers.

“BLS (Bureau of Labor Statistics) is the gold standard for employment estimates, and while there are other sources available, it’s difficult to gauge employment trends without BLS data,” said Gregory David, assistant director of the New Hampshire Economic and Labor Market Information Bureau.

In August, the unemployment rate for New Hampshire was 3%, up nearly a half percentage point from August 2024.

In raw numbers, about 3,350 more people were looking for a job this summer than the previous summer. (Note, we are comparing the average of only July and August 2025 with the average for the entire three-month third quarter of 2024.)

The size of the New Hampshire workforce grew by about 3,700 people over the course of the shortened year.

Paychecks seemed to flatten over the summer, with weekly factory-worker pay rising only $8 over the two months.

David said state officials have some alternative ways to measure the New Hampshire job market, for example with unemployment claims.

They have seen no indication of big changes in employment this past September, he said. Traditionally, September is a transitional month, with school-based employment resuming and summer jobs winding down.

“The U.S. labor market has been low-hire, low-fire for a few months, and the available data indicates that that has continued in September,” he said.

Also for New Hampshire, Gross State Product grew 2% in the spring. It contracted slightly in the winter months. Reporting on GSP, a wide category that shows all goods and services created in the state, is always three months behind.

Editor’s note: “The Pulse” is an exclusive feature of NH Business Review that examines local and national data to track New Hampshire’s economy.

Each month, the series examines an economic trend based on the latest data. On a quarterly basis, “The Pulse” will report key economic indicators such as employment, inflation and economic growth for the New Hampshire economy for a more expansive review that includes several informational graphics.

“The Pulse” focuses on three key indicators: prices, output and labor. It will also feature a wild card category. One of the six will change every quarter in an effort to capture data that gives additional insight.