Two recent national rankings show just how motivated people are to buy a home in New Hampshire.

First off, there’s a national ranking that shows New Hampshire is tied for No. 1 as the state where homes sell the fastest. The other state is neighboring Massachusetts.

Secondly, there’s a national ranking showing prices of a house have increased faster in New Hampshire than any other state over the last year.

A continuing short supply of homes to sell heightens demand as evidenced by these data sets of quick-selling homes and rising prices.

“These statistics do not surprise me at all,” said Ben Cushing, president of the New Hampshire Association of Realtors. “As I have been saying during my year as the president of the NHAR, New Hampshire is so appealing to so many.”

AgentAdvice, a real estate school and media company, said its data shows New Hampshire and Massachusetts share the top spot for the state’s fastest-selling houses, with homes in each state taking an average of 32 days to sell from when it’s listed. It’s a data point called days on market.

The national average, according to AgentAdvice, is 43 days. It said New York is the hardest state for selling a home, taking an average of 61.5 days to complete a sale, taking almost twice as long to sell a home there compared to Massachusetts and New Hampshire.

The price increase data comes from CoreLogic, which said home prices nationwide increased year over year by 3.7% in August 2023 compared with August 2022.

Leading the pack was New Hampshire with a year-over-year price increase of 9.4%. Rounding out the top four were other New England states: Maine at 8.9%, Vermont at 8.9%, and Rhode Island at 8.4%.

In a social media post that accompanied the CoreLogic information, the NHAR said: “New Hampshire needs more housing inventory of all kinds to meet the demand.”

“Many are looking to move out of the larger markets and come to a state like New Hampshire that offers not only the seasons but close proximity to Boston or New York,” said Cushing, director of learning and training at Coldwell Banker Lifestyles in New London. “New Hampshire also has very low unemployment, great hospitals, great educational institutions.”

The University of New Hampshire’s Carsey School of Public Policy bears out New Hampshire’s appeal. Its recent report on the state’s changing demographics said more than 111,000 people moved to New Hampshire in 2021 and 2022 compared to 93,000 who left the state during that time. And the largest percentage of those migrants — about 44% — came from Massachusetts.

“New Hampshire’s demographic future depends heavily on migration. The state’s population continued to grow in 2021 and 2022, because a migration gain of 18,300 was enough to offset the excess of deaths over births,” said the report’s author, Kenneth Johnson, senior demographer at the Carsey School.

The pace of the sale of residential properties in this state has continued unabated.

The NHAR’s October report said the days on market for a single-family home was 21, down from 26 in October 2022.

October’s median price of $477,000 was below the record-shattering $499,000 recorded in June, but it was still 11.1% higher than the median in October 2022.

The ability to afford a house in New Hampshire was at a historic low in October with an affordability index of 58. That’s one point lower than the previous lows recorded in August and September.

On the affordability scale, 100 means a potential homeowner in a particular market has enough funds to purchase, mortgage and insure the home. The lower the index, the less affordable the market is.

The months supply data point improved only slightly to 2 from 1.7 the year before for single-family homes. A balanced market generally has between 5 and 7 months of supply.

Residential condominiums are selling even faster than single-family homes, according to the NHAR data.

In October, a condo sold in an average of 20 days, two fewer than the year before.

The median price of a condo was $401,750 in October, short of the $405,000 record set in September but 11.6% more than the year before. The affordability index for a condo was 69, down 15.9% from the year before.

The months supply for condominiums in October was 1.6.

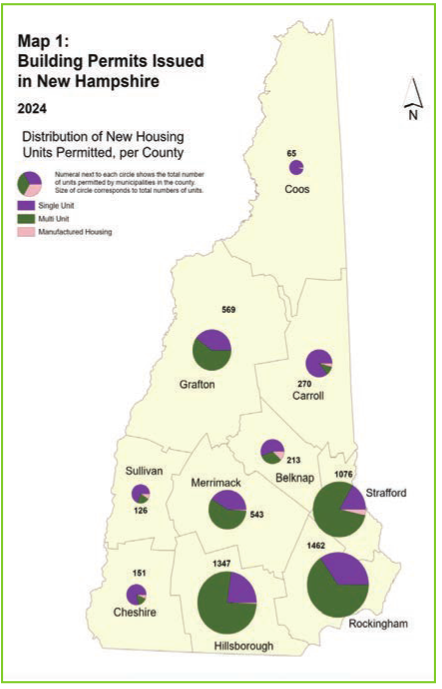

Rockingham continues to be the most expensive of the 10 counties in which to buy a home. The October median price was $625,000, compared to $600,000 in October 2022.

Rockingham was followed by Carroll at $525,000, Hillsborough at $500,000, and Belknap at $452,000.

Coos County recorded the highest condo median price at $811,000, because of a single sale for that price.

Within Rockingham County, the pace of sales has slowed down dramatically on the Seacoast, where the Seacoast Board of Realtors tracks data in 13 sample communities: Exeter, Greenland, Hampton, Hampton Falls, New Castle, Newfields, Newington, North Hampton, Newmarket, Portsmouth, Rye, Seabrook and Stratham.

The 63 single-family transactions it recorded in October was the fewest for October since 2011, despite inventory levels at their highest since July 2022. The median price of a single-family home slipped to $670,000, the lowest since March.

The number of condominiums — 45 — sales was the slowest October since 2013 and the fewest sales this year since March. The median monthly sale price of $520,000 is off 6.1% from last year.

“The pattern of fewer sales at higher prices seems to persist,” said Seacoast Board of Realtors President Jessica Ritchie, a broker at Great Island Realty in Portsmouth. “Mortgage rates have made things more difficult for both sides of the transaction, but buyers are very much engaged and activity remains strong.”