Coalition addresses increase in electricity rate

Following news of Nashua Community Power’s increased electricity rate for the next rate period, Community Power Coalition of New Hampshire (CPCNH) gave a presentation to the Board of Aldermen (BOA) during a special meeting to discuss the rate change and give an overview of Nashua Community Power.

Beginning February 1 through July 31, 2026, the rate will be 14.663 cents per kilowatt hour (kWh), up 1.24 cents from the previous rate period.

The rate is now 3.3 cents above the Eversource rate of 11 cents (kWh), which is about $21 more a month for the average electricity bill. Upon launching in April 2023, the rate was significantly lower than Eversource at 15 cents per kWh, compared to Eversource at 22 cents.

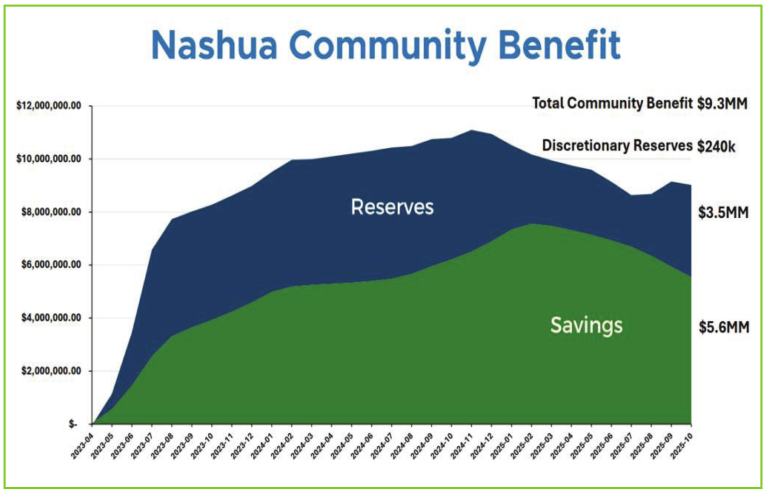

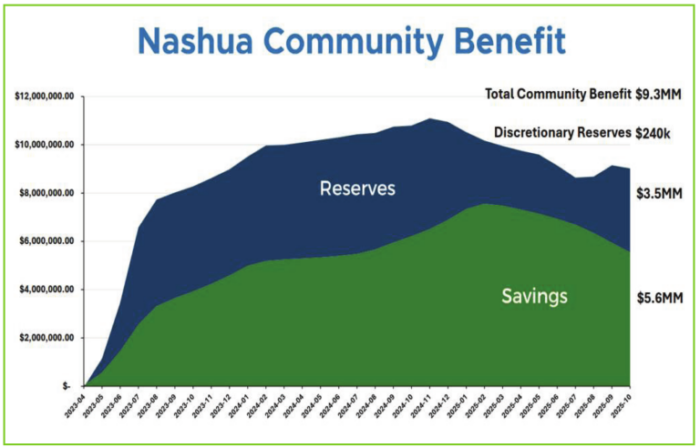

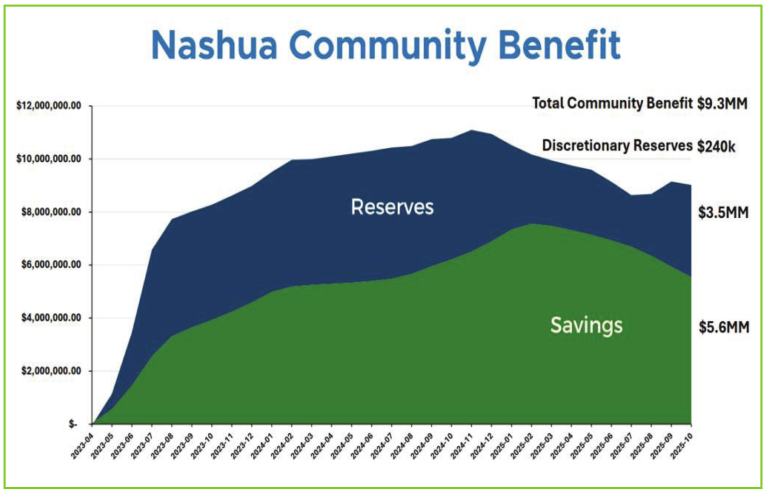

Through September 2025, Energy Manager Doria Brown reported that Nashua Community Power’s total revenue was $62,142,000, with $5,939,000 in customer savings.

While Nashua Community Power’s rate has risen, Eversource’s rate has decreased by following the approach taken by the coalition.

“Since we launched community power, the utilities saw how our community power programs were extremely successful because we were able to take advantage of the wholesale market and have an open position which allowed us to set lower rates,” Brown said.

Now, she said, utilities are also taking advantage of the wholesale market as opposed to getting a fixed rate contract.

CPCNH Acting General Manager Henry Herndon explained the buildup of the rate, which he said transparently reflects the cost of service.

Seventy-five percent of the rate is driven by the cost of energy, and a two-cent adder — making up 14% — will be contributing to Nashua’s reserves. The rest consists of ancillaries and DASI, fees applied to all energy suppliers in the New England wholesale market; capacity, a charge applied to the entire market ensuring sufficient availability of generators over time; renewable portfolio standards; and operating expenses of the coalition.

“The primary driver of the rate differential in the upcoming period is that reserve block and that is driven by a cash flow requirement,” Herndon said, explaining that there is a 60-day-plus lag between incurring of costs and receipt of revenue.

CPCNH’s reserve policy sets goals for the amount of money to be in the reserves and a plan is in place to achieve them, with some minimums projected to be met in 2028.

“Over time in the upcoming rate periods we will see several of these components decrease including energy with better portfolio management and more flexibility as we mature as an organization, and that reserve line as well as we meet certain minimum reserve balances and have a less need to accrue and rebuild reserve funds,” Herndon said.

Due to cold temperatures and changes in the natural gas market resulting in higher than expected wholesale market pricing, there was an unplanned draw on the reserves in the winter of 2025. This caused CPCNH to have to rely on third party financing.

The coalition is now in a stabilization/recovery phase to rebuild the reserves that were drawn down.

By building the reserve fund, the adder will lower and result in the lowering and avoiding of interest expense, eliminating and minimizing financing charges, diversifying credit support, eventually achieving secure credit rating and achieving low-cost capital.

Herndon said that the CPCNH board will discuss to determine the appropriate balance between the tapering of reserve growth, given sufficient minimums are met to balance rate relief with customers, while maintaining growth over time to reach targets.

“What we can anticipate moving through this rate period is perhaps a rebalancing of the breakup of the benefit, with a decrease in some savings to customers, but an increase in the reserves that support the longevity and long-term value of the program,” Herndon said.

This article is being shared by partners in the Granite State News Collaborative. For more information, visit collaborativenh.org.