The Pulse: Strong growth, fewer jobs

Is the New Hampshire economy up or down?

The New Hampshire economy has entered a good news/bad news phase, where strong growth is tempered by rising joblessness and paychecks that don’t keep up with an even slower rate of inflation.

The New Hampshire economy has entered a good news/bad news phase, where strong growth is tempered by rising joblessness and paychecks that don’t keep up with an even slower rate of inflation.

That is evident in the latest economic data found in “The Pulse,” a monthly snapshot of the state’s economy that is produced by NH Business Review.

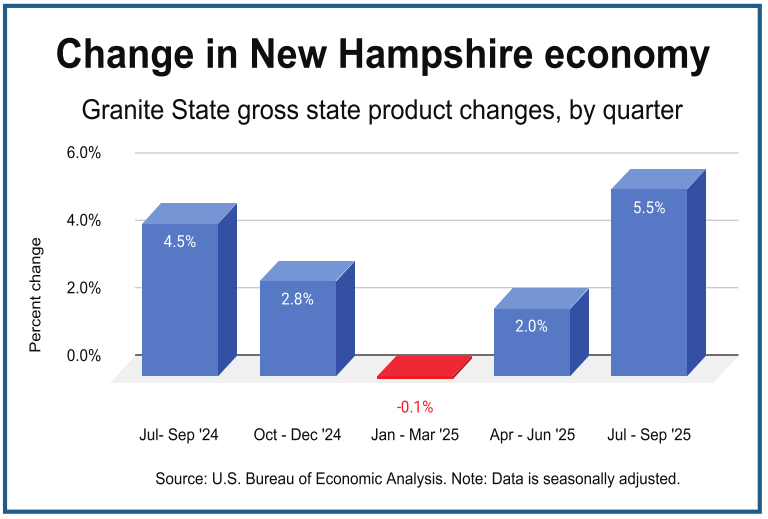

The New Hampshire economy grew 5.5% over the summer, one of the fastest rates in the country. Also, the New England inflation was a hair lower than the national rate.

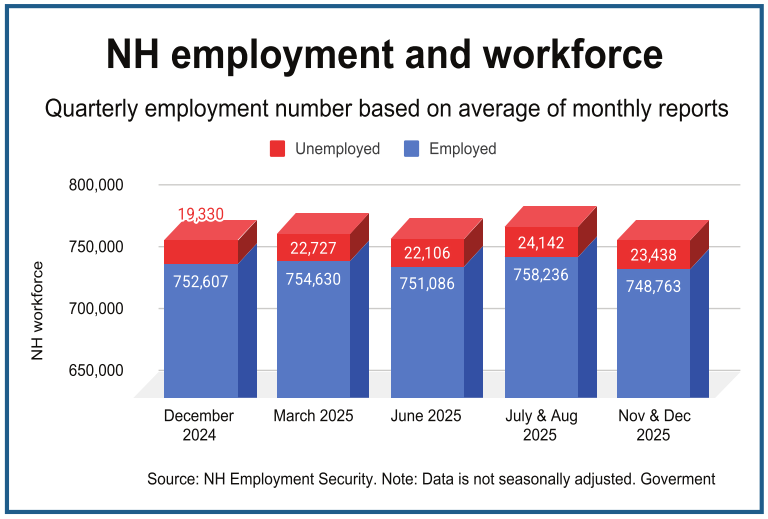

Yet, at the end of the year, nearly 4,000 fewer people were working than during the same period in 2024.

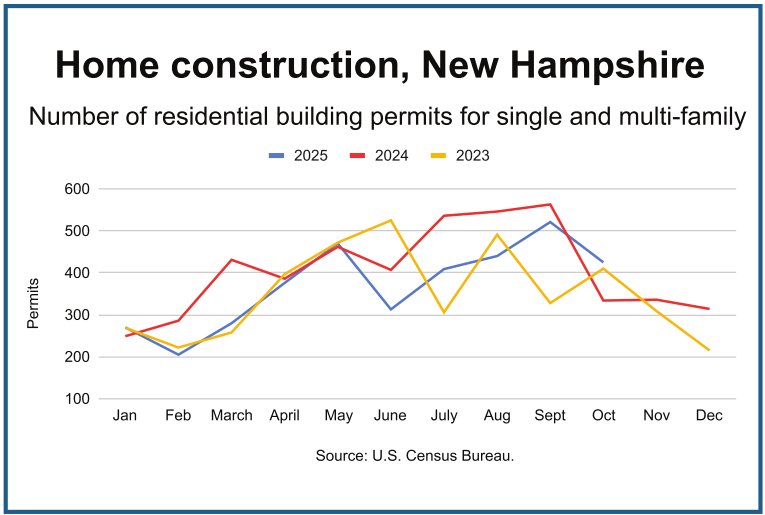

The strong edge of the economy shows up in other measurements as well. Residential building permits were stable for October, the latest month available.

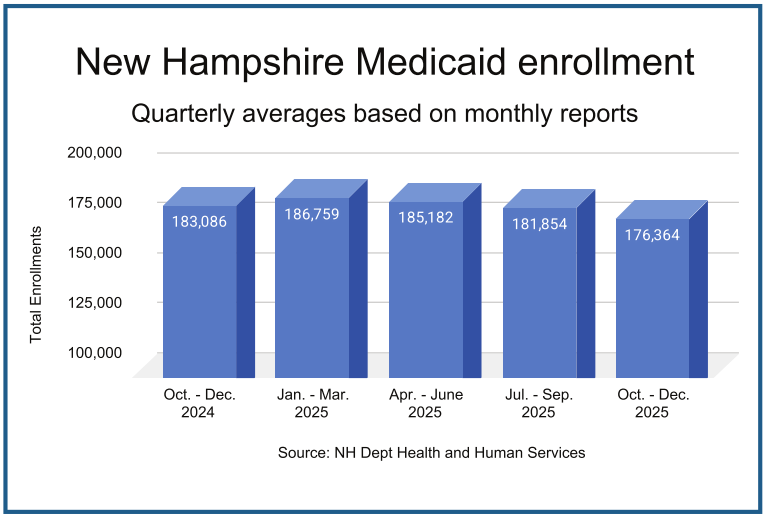

And enrollments in Medicaid, the state-run health care program for the poor, dropped throughout the year.

The biggest surprise is the muscular gross state product in the third quarter. Just six months earlier, the gross state product, the broadest measurement of goods and services produced in the state, had dipped into negative territory.

The U.S. Bureau of Economic Analysis reported that the state’s economy grew at an annual rate of 5.5% in the third quarter of 2025. (State GSP lags behind most other economic reporting.)

Economies in only six states had higher growth rates: Kansas (6.5%), South Dakota (6.3%), Arkansas (5.8%), North Carolina, Pennsylvania and Connecticut (all 5.6%).

For New Hampshire, the Bureau reported strongest gains in finance and insurance, science/technical services, health care and durable goods manufacturing.

Mark Manuel, an Amherst-based consultant who works with small to medium-sized manufacturing companies, said manufacturers have shaken off concerns about trade barriers and tariffs that dominated economic news earlier this year.

“If (President) Trump says 25% tariff, OK, they keep on going, they’re not so worried about it anymore,” said Manuel, co-founder of the firm Industrial Marketing.

Yet the unemployment rate in December 2025 was 3.1%, compared to a rate of 2.8% a year before. That translates into about 4,000 fewer jobs.

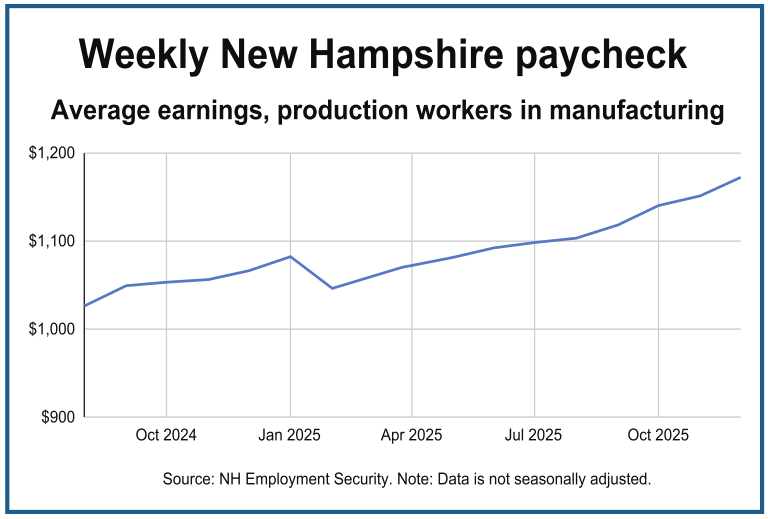

And the average weekly paycheck for a factory worker increased in December by a paltry $21, to $1,172. The increase works out to about 0.5%, far below the rate of inflation.

“We need to stop defining how the economy is doing by looking at the stock market,” said Glenn Brackett, president of the New Hampshire AFL-CIO. “The economy is only as strong as its weakest link.”

For workers, cost-of-living increases don’t keep up with price hikes of household budget items such as electricity and groceries, he said.

For workers, cost-of-living increases don’t keep up with price hikes of household budget items such as electricity and groceries, he said.

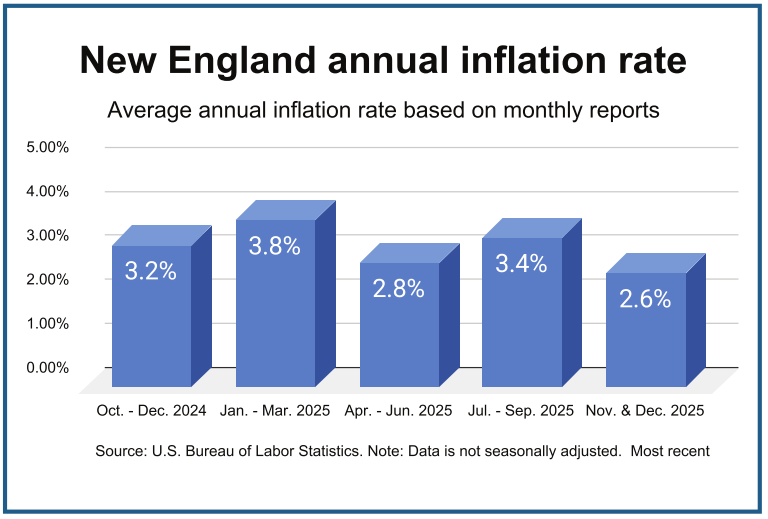

The annual consumer price index for New England averaged 2.6% over the last two months of December. (Because of the government shutdown, the U.S. Bureau of Labor Statistics did not release a regional inflation rate in October.)

The inflation rate is substantially cooler than the 3.4% annual rate seen over the summer.

The latest rate for New England is a hair lower than the national rate for the same period, 2.7%.

Manuel, who consults for manufacturing companies, thinks labor shortages are more responsible for inflation than anything else.

Still, he sees confidence in the economy. Trump’s Big Beautiful Bill, which includes immediate write-offs for equipment and machinery, also added a boost to manufacturing.

Six months ago, manufacturers were not aggressively hiring because of uncertainty over tariffs, Manuel said.

Now, they are more willing to hire but are being selective.

Manufacturers will hire workers and train them as long as they meet some rudimentary expectations such as showing up on time and sober, he said.

“The biggest challenge is showing up,” Manuel said.

Some companies would add a third shift if they could find the right workers, he said.

The average overall size of the New Hampshire workforce, which includes both workers and people looking for work, remained stable last year. The workforce comprised 772,201 people in the final quarter of 2025, about 250 more than the same period in 2024.

Brackett said one of employers’ problems is the fact that New Hampshire has no state minimum wage and defaults to the federal rate of $7.25 an hour.

Few New Hampshire employers pay such a low rate, but workers hear about a rate twice as high in other states and commute there to find work, he said.

“It’s a very bad message to prospective employers that we think so little of our people,” Brackett said.

“It’s a very bad message to prospective employers that we think so little of our people,” Brackett said.

Higher unemployment did not seem to translate into higher enrollments in Medicaid, the state-run program that provides healthcare to poor people.

Every three months, the Pulse picks a different economic measurement. This quarter it is Medicaid enrollment.

Enrollments were down by 6,700 people, more than 3%, compared to the final quarter of 2024.

The drop came before changes that are likely to diminish Medicaid roles in the near future. Tax credits to offset Medicaid premiums expire at the end of 2025, and work requirements are expected to begin at some point this year.

“The Pulse” is an exclusive feature of NH Business Review that examines local and national data to track New Hampshire’s economy.

Each month, the series examines an economic trend based on the latest data. On a quarterly basis, “The Pulse” will report key economic indicators such as employment, inflation and economic growth for the New Hampshire economy for a more expansive review that includes several informational graphics.

“The Pulse” focuses on three key indicators: prices, output and labor. It will also feature a wild card category. One of the six will change every quarter in an effort to capture data that gives additional insight.