While the median price of a single-family home in New Hampshire declined again in November, don’t assume it’s a trend toward greater affordability.

More likely, it’s because of seasonal trends in this region, according to Susan Cole, president of the New Hampshire Association of Realtors (NHAR).

Keep in mind that the November median house price of $525,000 was still 5% more than it was a year ago, she said. The NHAR noted that in terms of year over year comparisons, November was the 70th consecutive month for a price increase.

SHUTTERSTOCK

“The upward rise in single-family housing prices in New Hampshire is not abating,” said Cole, owner broker of Susan Cole Realty Group in Lebanon.

The single-family home median price peaked to an all-time high in June of $569,000. Since then, it’s been on a fairly steady drip downward: to $549,500 in July, $550,500 in August, $535,000 in September, $533,000 in October, and now $525,000 in November.

Here is a comparison of those same months from 2024: $540,00 in June, $530,000 in July, $535,000 in August, $520,000 in September, $505,000 in October, and $500,000 in November.

Cole noted that buyers nationally took advantage of lower mortgage rates this fall, resulting in increased sales in the South and Midwest.

“In some parts of the country, buyer activity is picking up this fall as mortgage rates have retreated. The 30-year fixed rate mortgage averaged 6.26 percent in the latest week, down from a 7 percent average at the start of the year,” she said. “However, in New Hampshire we are not really seeing activity increase as closed sales were flat in November compared to the same period last year.”

“It underscores the fact that national housing statistics are not that instructive when comparing to what is actually happening here in New Hampshire,” she added. “It is also important to keep in mind that real estate is seasonal, with activity increasing in the spring and summer and subsiding in the fall and winter months.”

One measure of the pace of sales is the days on market data point – how long it takes on average for a property to sell.

According to Cole, days on the market typically lengthen from November through February.

“The average days on the market for a single-family home in New Hampshire is now 33 days, up from 19 days in June,” she said. “The flip side of that equation is the number of homes for sale decreases in the fall and winter months. And we are seeing that trend with about 2,100 homes on the market in November, down from 2,700 in September.”

She noted that not all of New Hampshire is seeing the same level of demand. According to Cole, Rockingham County is seeing an average of 24 days on the market, while in Grafton County single-family homes are averaging 51 days.

Cole is in her last month as the 2025 president of the NHAR. She’s being succeeded by Joshua Greenwald, owner broker of Greenwald Realty Group in Keene.

Additional data to consider from November are the affordability index and volume of closed sales.

The affordability index measures exactly that – how well a household can afford a home in a given area. An affordability index of 100 means the household has just enough money. New Hampshire’s affordability index in November for a single family was 60. The affordability index for a townhouse/condominium was 73, with the median price of a unit reporting in at $412,000 in November.

The dollar volume of sales in November was $640.2 million for houses, $150.3 million for condos, increases of 11.7% and 7% respectively from a year ago.

That’s good new for state of New Hampshire revenue, because the state imposes a Real Estate Transfer Tax (RETT) when residential and commercial property are sold.

The RETT produced $26.3 million in revenue for the state in November, which is $5.7 more than estimates and $7.1 million more than a year ago. The RETT has been one of the bright spots of state tax revenue, according to the latest revenue report from the state.

Business taxes have produced $283 million thus far, which is $6.8 million less than in fiscal 2025, and $22.7 million less than estimates. Rooms and meals revenue was $200,000 below estimates, returning $31.1million for November, which is $600,000 more than a year ago.

The Lottery Commission produced $20.4 million for November, $5.1 million more than estimates and $7.1 million more than a year ago.

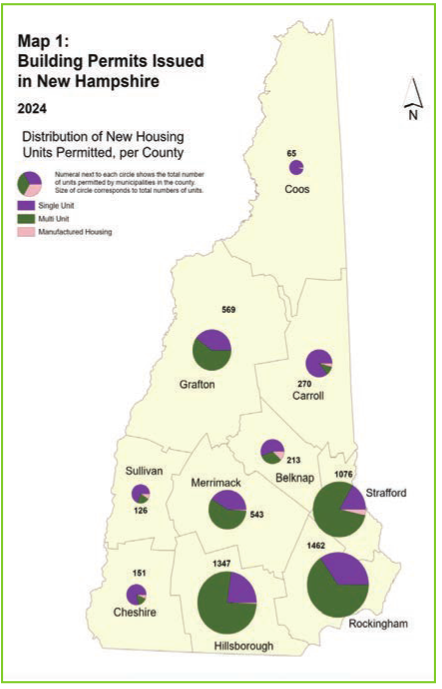

Here, by county, are the median prices for homes in November:

Belknap: $570,000

Carroll: $455,000

Cheshire: $413,500

Coos: $254,950

Grafton: $460,000

Hillsborough: $535,000

Merrimack: $515,000

Rockingham: $652,500

Strafford: $460,000

Sullivan: $375,000

Here are the November median condo prices:

Belknap: $452,000

Carroll: $350,000

Cheshire: $378,750

Coos: $614,000

Grafton: $365,000

Hillsborough: $395,000

Merrimack $405,835

Rockingham: $532,500

Strafford: $419,900

Sullivan: $500,000