John Cunningham

There are about 15,000 New Hampshire two-member LLCs in good standing. Because they face a lesser risk of veil-piercing than single-member LLCs, two-member LLCs can provide both of their members with significantly stronger statutory asset protections than single-member LLCs. For that reason, even LLCs in which only one member will actually be conducting the LLC’s business should often be structured as two-member LLCs.

However, as discussed in a previous column, two-member LLCs face an inherent and substantial risk of irreconcilable disputes between the members and thus of LLC divorce. Obviously, single-member LLCs don’t face this risk.

How should the members of two-member LLCs address this risk? The New Hampshire LLC Act does not answer this question, and in the case of every two-member LLC, the answer will often depend on unique facts. However, here are some general answers likely to be useful to the members of many New Hampshire two-member LLCs:

- Every two-member LLC should have a written operating agreement that expressly addresses and resolves, among many other issues, the above possibility of irreconcilable inter-member disputes. The most common operating agreement provision addressing this possibility provides for the resolution of these disputes by arbitration or litigation. However, if only one of the members of a two-member LLC actually operates its business, the operating agreement should often provide that if such a dispute arises, the passive member must resign but will be entitled to a fair market value buyout of his or her membership.

- The operating agreement of a two-member LLC should also provide (i) that if, for any reason, the membership of one of the members is terminated and the LLC thus becomes a single-member LLC, no provision of the LLC’s operating agreement as a two-member LLC will continue in effect; (ii) that in this situation, the remaining member of the LLC must adopt a written operating agreement suitable for a single-member LLC; and (iii) that until the remaining member does so, the LLC will be governed by the default provisions of the New Hampshire LLC Act that govern single-member LLCs. These provisions are set forth in New Hampshire LLC Act sections 151 through 154.

However, for many two-member LLCs that become single-member LLCs, one or more of the above statutory provisions may be inappropriate. Thus, the remaining members of two-member LLCs, by themselves or with the help of their lawyers, should review these provisions and, in a written single-member LLC operating agreement, should expressly override these provisions to the extent necessary.

- In particular, the operating agreements of two-member LLCs should expressly provide that if these LLCs become single-member LLCs for any reason, none of the management provisions of the operating agreement of the LLC as a two-member LLC will apply. This is to prevent any argument by former members of two-member LLCs that although they are no longer members of these LLC, they are still managers of it.

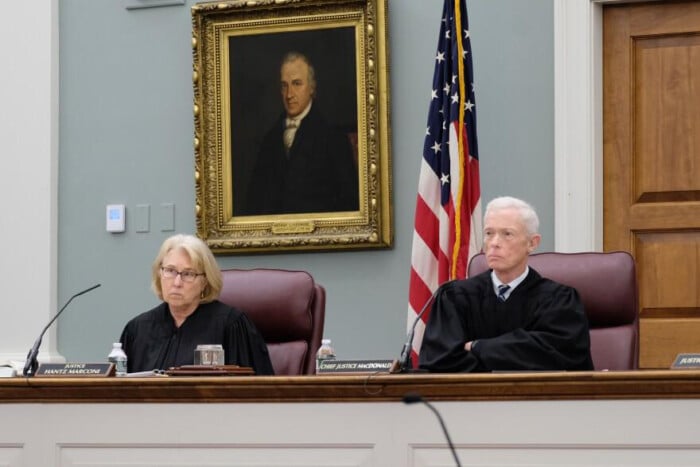

The necessity of such a provision in the operating agreements of two-member LLCs is demonstrated by a recent New York case, Stewart Family LLC v Barbara Stewart.

Because the operating agreement of the Stewart Family LLC lacked such a provision, the divorced Stewart family spouses, each of whom had been both a member and a manager of their LLC, engaged in litigation about the management of the LLC for more than a decade. This litigation undoubtedly cost the Stewart spouses of many tens of thousands of dollars in legal fees and untold personal anguish.

The message for members of New Hampshire two-member LLCs is clear: Beware of the Stewart case.

John Cunningham is an attorney of counsel to the law firm of McLane Middleton whose practice is focused on LLC law and tax. He can be contacted at lawjmc@comcast.net, 603-856-7172 or llc199A.com.